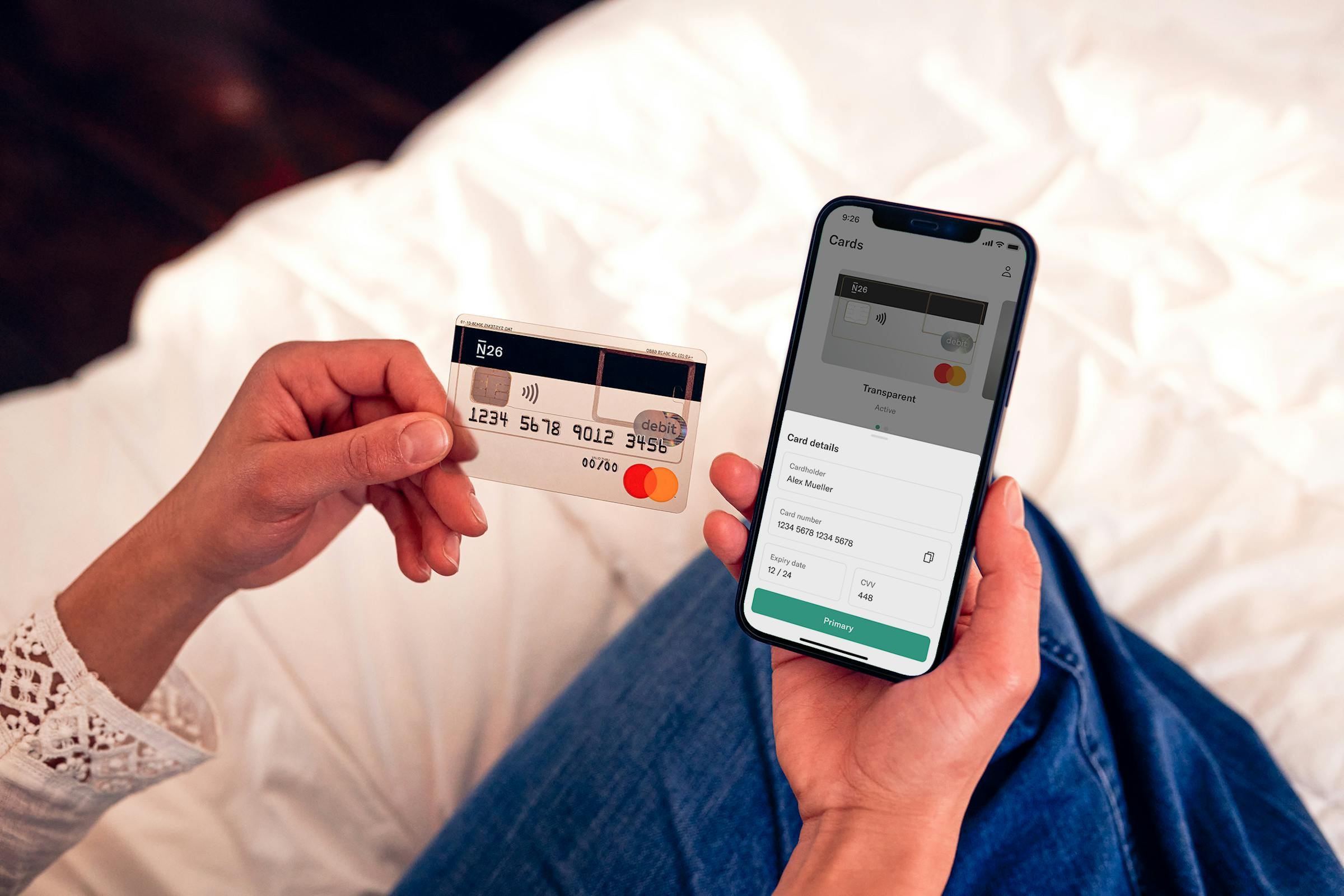

In today’s digital age, convenience and security are paramount when it comes to managing finances. Traditional payment methods are gradually being replaced by innovative digital solutions, and virtual card apps are at the forefront of this transformation. These apps offer users the flexibility to make online purchases, manage subscriptions, and track expenses seamlessly. Check out: best virtual credit card

Let’s explore some of the best virtual card apps that are reshaping the way we handle transactions.

· Privacy: Privacy is a leading virtual card app that prioritizes user security and convenience. With Privacy, users can generate virtual debit cards on-the-fly, each with its own unique number, expiration date, and spending limit. This enables users to protect their primary card details while making online purchases, reducing the risk of fraud and unauthorized transactions. Privacy also offers features such as single-use cards, merchant-specific cards, and transaction categorization, allowing users to manage their spending effectively.

· Revolut: Revolut is a comprehensive financial platform that offers a range of services, including virtual cards. With Revolut, users can create virtual cards in multiple currencies, making it ideal for international travelers and online shoppers. The app also provides real-time transaction alerts, budgeting tools, and peer-to-peer payments, empowering users to take control of their finances. Additionally, Revolut offers premium subscription plans with enhanced features such as travel insurance and unlimited FX transfers.

· Curve: Curve is a unique virtual card app that consolidates all your existing cards into a single digital platform. With Curve, users can link their credit and debit cards to the app and seamlessly switch between them when making payments. This not only streamlines the payment process but also offers additional benefits such as fee-free foreign currency transactions and instant cashback rewards. Curve also provides expense tracking and budgeting features, helping users stay on top of their finances.

· Zerocard: Zerocard is a virtual card app that is designed to help users build and maintain healthy credit habits. With Zerocard, users can create virtual cards linked to a credit line based on their financial profile. The app offers a unique feature called “Perfect Match,” which analyzes users’ spending patterns and suggests the most suitable card for their needs. Zerocard also provides personalized rewards and cashback incentives for responsible spending, making it an attractive option for users looking to improve their credit score.

· Token: Token is a virtual card app that focuses on security and privacy. With Token, users can generate virtual cards with dynamic card numbers, making each transaction unique and virtually immune to fraud. The app also offers advanced security features such as biometric authentication and device locking, ensuring that users’ financial information remains secure at all times. Token supports a wide range of payment methods and integrates seamlessly with popular e-commerce platforms, making it a convenient choice for online shoppers.

In conclusion, virtual card apps are revolutionizing the way we handle transactions in an increasingly digital world. Whether you’re concerned about security, convenience, or managing your finances effectively, there’s a virtual card app out there to suit your needs. By leveraging innovative technologies and user-centric features, these apps are empowering individuals and businesses to navigate the complexities of modern finance with confidence and ease.

For more information regarding virtual credit card app visit our website: https://shashap.com/

Comments on “Streamlining Payments: Exploring the Best Virtual Card Apps| Shashap”